The impact of covid-19 is difficult to overstate, not only in the effect it’s hard on the local economy and working conditions - lockdown, work from home, freezes in venture capital funding - but in the way that its affected the global markets, for those Fintechs that are looking outwardly to the US and beyond.

In our latest report Fintech in Scotland: A Snapshot of 2020, we look at some of the biggest challenges facing financial services across the nation and how they can turn those challenges into new opportunities.

This extract takes a look at the challenges faced by the financial services sector, including shifting and unpredictable global markets, maintaining cash flow and funding and the impact of infrequent and volatile collaboration and how it’s slowing down growth.

The Unpredictable Markets of the Pandemic and Impact on Scottish Financial Services

As with all large-scale economic slumps, the challenges that are presented require a global and community level response. Part of this, as Pinsent Masons reports, is businesses assessing and adjusting their finances, 2020 plans and strategies and the markets that they operate in.

This large scale reassessment of finances and market strategies comes down to the way global markets are responding to Covid-19 and the challenge of creating a unified response: some markets remain challenging, others are sealed off, and a few are open for business.

The challenge this poses for the Scottish Fintech cluster is balancing global sales and growth strategies with customer needs and the rates that target markets are opening and ending Covid-19 related lockdowns.

The balancing act becomes clear when looking at Eversheds Sutherland’s report on prevailing global trends and the potential for large scale missed opportunities as funding freezes. When this is combined with challenging markets and a new customer readiness to switch to products that have less face-to-face time and a stronger digital presence it’s easy to see how big a shift this could be.

There is a view, globally, that investors are keeping their powder dry and any freeze in funding is only a temporary measure and Fintechs, among other industries, are being temporarily bolstered by SME targeted stimulus packages.

The Challenges of Maintaining Cash flow and Funding

One of the impacts of Covid-19’s on the Scottish financial services sector is the similar downward trends on cash flow and funding, that have been seen across the global markets.

Experts believe that the industry is well equipped to weather the storm but that it will still be a monumental challenge as prospective customers turn away from challenger banks that are less equipped to provide support and towards more traditional financial institutions.

In fact, Law firm Womble Bond Dickinson reports that the profitability of all financial institutions will be hit by the effects of the crisis, further reporting that many of its clients had been inundated with requests for repayment holidays and loan variations.

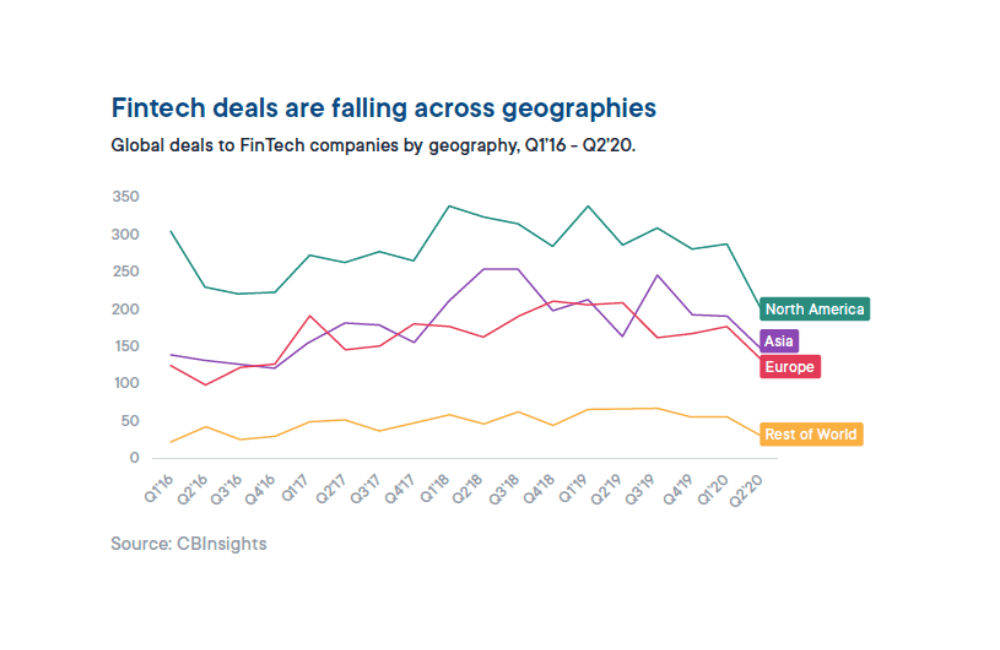

This is in line with reports from Fintech Magazine that VC backed funding for some sections of the Fintech cluster has fallen quarter over quarter since the pandemic hit. This is in stark contrast to the global year-on-year growth that Fintech and financial services funding saw from 2015 to 2018, where $17.1bn quickly grew to more than $40 billion.

This 180 degree shift has seen the future of Fintech change dramatically with CB Insights reporting that funding decisions have undergone a rapid shift and the pandemic has ended the thriving, rapid growth environment. This includes a 30% drop in funding for Q2 2020.

This could disproportionately impact smaller, early-stage, Fintechs who are less likely to see funding as investors turn to larger, more mature companies with an eye on doubling down on existing, successful, investments. This began to play out in the second quarter of 2020, where early stage deals saw a crunch and mid-stage rounds saw an 8% increase in deal share.

Volatile Collaboration and the Challenge of Getting it Right

Increased collaboration across the sector will help businesses break down the silos they exist in and bring more value to their customers and the market.

However, before that collaboration can happen there are some frustrations that need to be worked through.

Cap Gemini’s World Fintech Report says that frustration stems from a lack of agility, ROI, historical processes and not finding the right partner.

The report highlights that:

Only 21% of banks say their systems are agile enough for collaboration

Only 6% of banks have achieved the desired ROI from collaboration

70% of Fintechs don’t culturally or organisationally see eye-to-eye with their bank partner

More than 70% of Fintechs say they are frustrated with the incumbent’s process barriers

Half of Fintech executives say they have not found the right collaborative partner.

The shift of businesses and customers to a more digital first approach highlights the importance of removing these frustrations to build a stronger, more collaborative approach. In fact, the report goes so far as to say that traditional banks risk being left behind and could depend, in a disproportionate way, on collaboration with the Fintech sector.

Specifically, the report highlights the need for banks to invest in middle and back-end operations that focus on building the customer experience and that the role of Fintechs in the ecosystem needs to be evolved from serious competitors to formidable and important partners in order to achieve this.

An important part of creating streamlined and effective collaboration is the Open X Readiness Index, which evaluates banks based on 98 data points to check how ready they are for collaboration across the four pillars of People, Finance, Business and Technology.

What can Financial Services and Fintech do about these Challenges?

Despite all of this, the financial services sector in Scotland still has a positive outlook for the end of 2020 and into 2021. The challenges will take some navigating but there’s a lot of opportunities to come from them.